“If you ain’t first, you’re last.”

I don’t know if wiser words have ever been spoken. We should all try to think a bit more like the great Ricky Bobby.

There are different ways one can aim to be first. In a car race—where everyone starts from roughly the same point—speed is what matters. Small differences in speed compound over great lengths; a little bit faster car will go a whole lot farther over hundreds of miles.

It reminds me of this passage from James Clear’s Atomic Habits:

Imagine you are flying from Los Angeles to New York City. If a pilot leaving from LAX adjusts the heading just 3.5 degrees south, you will land in Washington D.C., instead of New York. Such a small change is barely noticeable at takeoff—the nose of the airplane moves just a few feet—but when magnified across the entire United States, you end up hundreds of miles apart.

Your starting point can have a profound impact on where you end up over long time horizons…if you can’t make adjustments. When you board an airplane and it takes off, though, it doesn’t really matter all that much if the pilot is off by a few degrees.

I wrote about this idea in my article How to Improve Your Decisions Immediately:

By focusing on choices as existing dynamically, it increases the value of trial-and-error. That is, when you can iterate to “change” the EV of a decision repeatedly over time, it decreases the importance of prior choices.

This should be obvious in the airplane example: would you rather be on a cross-country flight with a pilot who spends countless hours attempting to calibrate the most precise takeoff angle but can’t make adjustments along the way, or one who just sort of takes off in the general direction of New York but can make unlimited adjustments? Uh, yeah, the second one.

In my article The Secret to Success: Mimic Evolution, I added:

The faster and more efficient you can make this trial-and-error cycle, whether it’s in your personal life or your business life, the quicker you will find success. Your starting point for truth is way less important than your process for refining and improving your beliefs, especially when you get away from a static worldview and begin to (appropriately) see it dynamically. Over time, differences in the speed at which you can process information and adapt become exponentially more important than where you begin.

By speeding up your trial-and-error cycle, the returns compound over time; being twice as fast doesn’t make you just twice as better, but rather exponentially so.

Recently, though, I realized that my claim that “your starting point doesn’t matter” is seemingly at odds with another Lucky Maverick principle I hold to be true: the easiest way to maximize payoffs is to limit competition, and perhaps the best way to limit competition is to be first (or early) to a particular niche.

When I look back at my personal triumphs and failures, there’s indeed a trend of finding more success when I’m somewhat early in finding new trends, whether it’s business or crypto or, recently, Topshot (see why I spent $35,000 for a video you can find all over the internet). That’s not to say I’ve been “first” by any means, but simply that the degree to which I’ve benefited from getting involved in a new project is very much correlated to how “early” I found it.

And, at the extremes, the benefits of timing are magnified and non-linear. Buying Bitcoin six months after its launch wasn’t four times more valuable than two years after; it was monumentally more valuable. Investing in Topshot moments one month after the site launched wasn’t four times more valuable than four months after; it was dramatically so.

The timing of finding a potentially lucrative niche is a sort of “singularity” of value; the closer you get to the starting point, the more extreme the effects become. As you approach that singularity and the payoffs become intense, it just seems intuitively true that it must outweigh anything else.

So what’s more important, being early or evolving quickly? Were my seemingly contradictory thoughts on speed vs. starting point truly at odds with one another?

To sort out this MAYHEM, I did what any sane person would do and charted it in Excel.

A Thought Experiment on Speed and Compound Returns

Just as the benefits of +EV investing or exercising or honesty compound over time, so do that of speed. To demonstrate this, I made a graph of hypothetical growth of something that doubles in value every cycle versus every other cycle.

Fairly quickly, the compounding advantages of fast iteration are apparent. Again, someone who works twice as fast with the same quality as someone else isn’t just twice as valuable; they’re exponentially more valuable.

Having a head start matters, too. Assuming the same speed of evolution between each cycle, there’s a gigantic edge in being first.

These effects, too, are exponential. “Move fast and break things” generally works as an approach to building, learning, and evolving because the positive effects of rapid iteration compound over time. Being early to a niche is also of incredible importance.

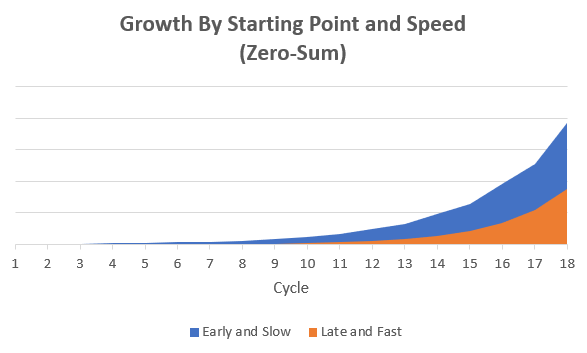

Both speed and timing matter, and they matter a lot. But which is more important, being early or evolving rapidly? Take a look at value over time for someone who is early but slow (starts first cycle, doubles every other) versus late and fast (starts sixth cycle, doubles every one).

“Late and fast” wins in a landslide. This seems to confirm the idea that iteration is more important than starting point, but then I had a realization: although both speed and starting point are important, speed matters more in non-zero-sum situations, while being early matters more in zero-sum games.

When it comes to Topshot or other competitive games, for example, the results are zero-sum, or at least closer to zero-sum than represented above. Think of a sporting event; each percentage point one team increases in win probability means the other team decreases the same amount.

This makes it of incredible importance to find winning strategies before others. When Billy Beane and the Oakland A’s employed “Moneyball,” using data to uncover undervalued players, the benefits of such an approach were theirs and theirs alone to enjoy. Nowadays, most or all teams have analytics departments that do far more than what the A’s were doing in the early-2000s, and so the advantages of weighing certain stats are dispersed throughout the league; in zero-sum games, it’s not what you know, it’s what you know that others don’t.

I charted the same numbers as the graph above, but this time took out just 20% of the value generated by the “late and fast” participant. That is, they still start on the sixth cycle and still improve twice as fast as the “early and slow” participant, but this time we assume there’s only 80% of the value remaining at each cycle (the multiple changes from 2x to 1.6x).

That small change produces this:

This is pretty amazing to me. When “late and fast” can acquire all available value to truly double every cycle, it ends up generating 32x the value as “early and slow” after just 12 cycles. But by removing just 20% of the value “late and fast” can accrue, it generates roughly half the value as “early and slow”—64x less on just a 20% value reduction.

The exact percentages here are irrelevant. What’s important is that very small changes to payoffs can dramatically affect long-term value. The more a game trends toward zero-sum, the more important it is to be early, as there are compounding rewards in the form of higher payoffs. This doesn’t mean the game itself needs to truly be zero-sum; investing in the stock market (or Topshot right now) is historically +EV, but you’re still competing with others, and the race to capture that EV is zero-sum, i.e. if the baseline return is +5%, then you’re losing if you return +4%.

Now compare these games of competing minds to something like learning to play the piano. As you become better and better, you’re not stealing piano-playing ability from anyone else. Over a pretty short time horizon, your starting point for learning is less important than how quickly you can improve via trial-and-error. In the case of non-zero-sum games, speed matters more than starting point.

Going back to the airplane example, the reason that the takeoff angle is of minimal importance is because the “game” of getting across the country is non-zero-sum. But what if pilots were in a competition to see who could reach the final destination as quickly as possible with as few “turns” as possible? Then the takeoff angle matters a whole lot more. When the dynamic transforms to zero-sum, there’s a shift in the relative importance of speed and starting point.

Expected Value = Probability * Payoffs. When the payoffs of what you’re trying to accomplish are affected by others, timing matters. A lot. In zero-sum games, your biggest edge will come by getting in on the ground floor to limit competition.

In non-zero-sum games, timing doesn’t matter as much. The payoffs of eating healthy or working out or learning a new language aren’t affected by anyone else, and so you’ll achieve the greatest compounding returns by speeding up your learning process via rapid trial-and-error.

Are You Okay Looking Like a Fool?

The benefits of being early and working quickly are obvious. Being early is a sort of overarching multiplier on the value of future work, while quick iteration allows for a lower multiplier that gets repeated over time. The earlier you are, the higher the initial multiplier, and the faster you can iterate, the greater the repeated multiplier. Both lead to compounding returns.

So then why does everyone seem to shy away from things when they’re new and work so slowly even once they’re established? Because they’re scared.

Fear is an incredibly powerful motivator. Isn’t it amazing how many people shy away from buying Bitcoin at X price, for example, but are all-in at 2X? It’s scary to be on an island, and when you’re wrong, everyone knows it.

But you can’t really have extraordinary gains by doing things like others, so you have to get over the fear. The easiest way to do that is to provide yourself constant reminders that the payoffs are worth it.

To get in early, you need to find things before they’re popular. To iterate as fast as possible, you need to be okay failing repeatedly. There’s no trial-and-error without error.

We don’t need fancy graphs to tell us what to do. Well, I do, but you probably don’t. All you need is a little courage to do things a little differently.

Once you accept failure as an inevitable outcome of pushing boundaries, you become free to do what you truly believe is best.

We have two lives, and the second begins when we realize we have one.